Taxing the Individual vs. Taxing Corporations: History shows the burden is on Individuals and not Corporations

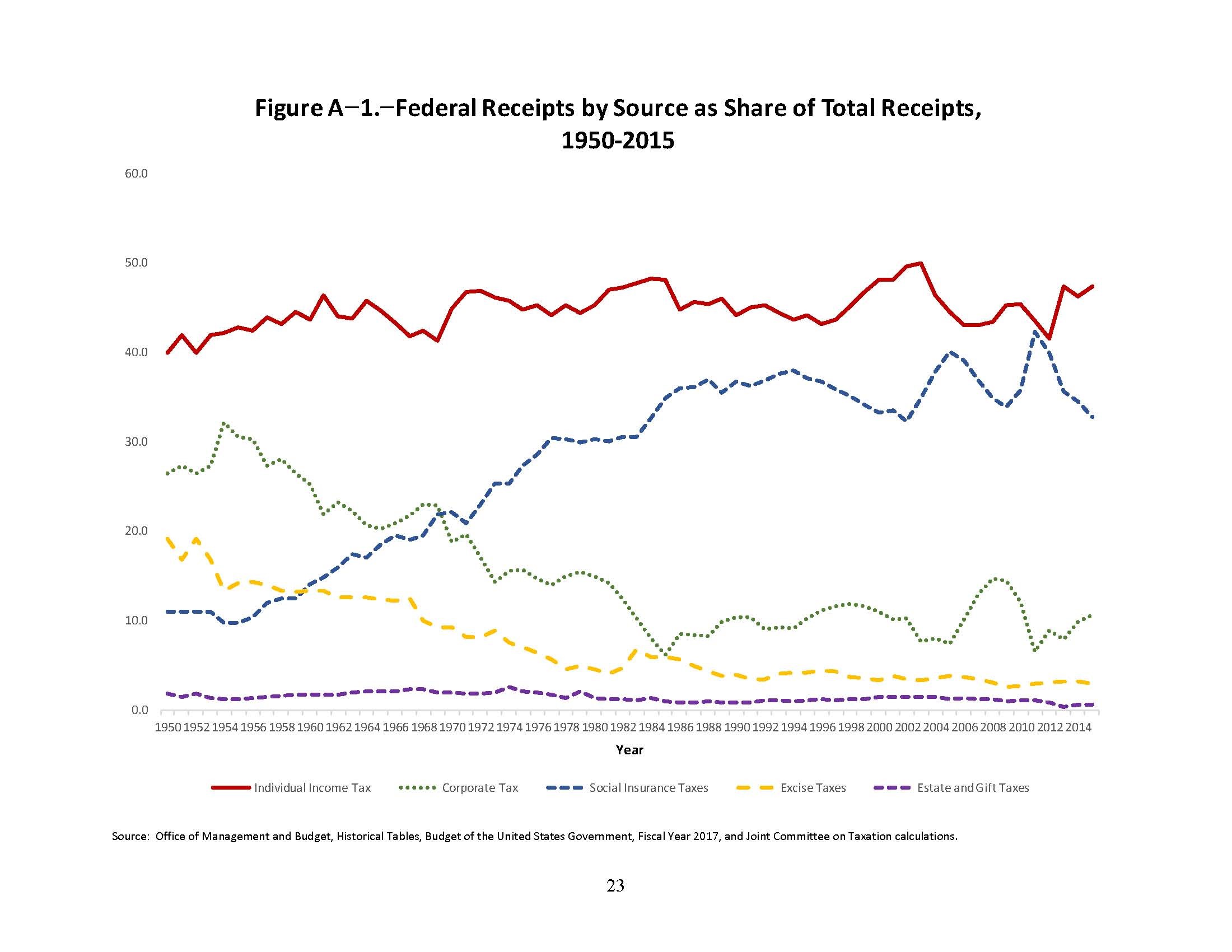

/As discussed in the TaxProfBlog the Joint Committee on Taxation has released its overview of the federal tax system. Noteworthy in the JCT’s finding is in table A-1 on pg. 23, the corporate income tax revenues received by the IRS has steadily declined since 1950, while individual income taxes and social security taxes continue to rise. See the chart below:

One possible explanation for the decline in the corporate tax receipts may be the erosion of the corporate tax base by U.S. multinational corporations (“USMNCs”) and their profits shifting from the United States. See TaxProfBlog and Kimberly A. Clausing (Reed College), Profit Shifting and U.S. Corporate Tax Policy Reform.

Clausing argues that the U.S. is losing over $100 billion dollars a year due to profit shifting efforts of USMNCs. See Chart below.

Ms. Clausing states that 98% of the profit shifting occurs by USMNCs to jurisdictions that taxes the USMNCs at less than 15%. Finally, she states that the revenue decrease has grown 5 times over the past decade due to increase profit shifting by USMNCs.

To combat the erosion of profits to offshore jurisdictions, Ms. Clausing proposes the following small changes to the current taxing regime:

- Repeal the check the box regulations that facilitates income shifting [for more information on check the box regulations and use in international tax planning, see this Wikipedia article];

- Tougher earnings stripping laws [Treasury has already instituted additional regulations to curb earnings stripping, see my blog]; and

- Anti-inversions rules such as an exit tax [See my earlier blog about imposing an exit tax to dissuade corporate inversions].

Ms. Clausing also advocates for the following fundamental changes to the existing taxing regime:

- Worldwide consolidation of corporate returns for tax purposes

- Formulary apportionment of international corporate income, using a method similar to that used by U.S. states in taxing national income.

Ms. Clausing’s proposal suggests that the U.S. should move to a territorial tax system. While some have advocated the territorial tax systems would create jobs and raise wages for U.S. workers, see this article by Curtis S. Dubay and the Heritage Foundation, others (Center on Budget and Policy Priorities) have advocated that such a transition would: 1) create greater incentives for USMNCs to invest and book profits offshore, 2) reduce wages in the U.S., 3) would cause larger budget deficits by draining corporate tax revenues, and 4) would shift the tax burden to domestic businesses and small businesses.

Regardless of the solution proposed by either side, the simple fact still remains that individuals in the U.S. continue to bear the brunt of the tax burden, while corporations continue to avoid paying taxes.

If you have specific/credible information about corporations avoiding the payment of tax through transfer pricing, inversions and earnings stripping, you can get involved in preventing/limiting the tax avoidance by filing an IRS tax whistleblower claim. The IRS pays an award between 15% to 30% of the tax collected to a whistleblower with specific and credible information about a corporate taxpayer’s avoidance of tax (through transfer pricing, inversions and earnings stripping). Contact us if you want to file a tax whistleblower claim.